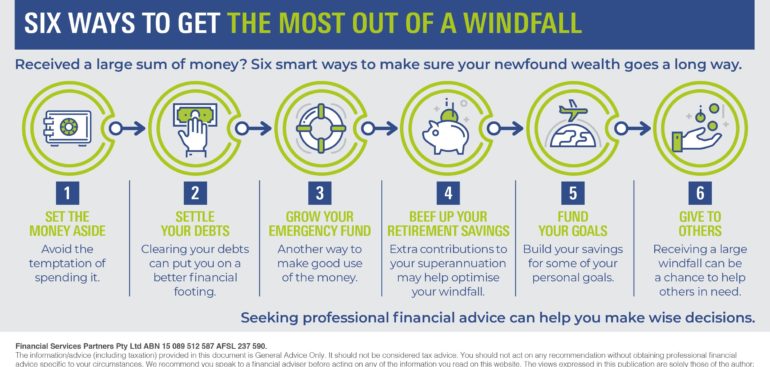

Received a large sum of money? By taking some practical steps, you can make sure your newfound wealth goes a long way.

Research has shown that on average, people who receive an inheritance spend about half of it.

So how can you make sure your windfall doesn’t just vanish but helps you build a secure financial future? Here are six smart ways.

1. Set the money aside

To avoid the temptation of spending it impulsively, you could put the money away temporarily in a deposit account or short-term investment instrument. Leaving the sum aside for one or two months may give you more time to plan or engage a professional financial adviser for guidance on using the money wisely.

2. Settle your debts

Using your windfall to clear your debts can put you on a better financial footing. Consider working with your financial adviser to create a budget that considers all your debt obligations, income and windfall. This can also be a good chance to discuss the opportunity to invest and grow your money.

3. Grow your emergency fund

Building up your emergency fund – or creating one if you haven’t already done so – can be another way to make good use of the money. By increasing the fund to cover your expenses for six months, you may be better positioned to handle unexpected events such as a job loss.

4. Beef up your retirement savings

Making extra contributions to your superannuation may help you optimise your windfall. Whether you make non-concessional contributions or, if you are employed, arrange to have a portion of your pre-tax salary paid to your super, increasing your retirement savings can help you secure your financial future.

5. Fund your goals

You may take this opportunity to build your savings for some of your personal goals, such as pursuing higher education or travelling to places on your bucket list. But consider doing this only after you’ve paid off your debts and built up your emergency fund.

6. Give to others

Receiving a large windfall can be a chance to help others in need. If you decide to give some money away, consider donating it to an organisation that’s entitled to receive tax-deductible gifts, so you can claim a tax deduction.