According to a recent survey by research firm East & Partners for lender Scottish Pacific, nearly 80 per cent of owners of small and medium enterprises said cash flow issues caused them the most sleepless nights. So what might you do to improve your cash flow and sleep better at night? […]

The investment world can change dramatically from one month to the next. But these secrets of successful investors never go out of style. Successful investing can be one of your biggest allies in the quest for long-term financial security. Unfortunately, unsuccessful investing can leave you wishing you’d kept your money in […]

Did you know there is about 14.8 million Australians with a superannuation account, 40% of which hold more than one account? Some of that 40% make up the $18 billion in ‘lost super’. Is some of that yours? Find it Moved house? Changed jobs? Don’t know where your teenage self stashed […]

Your ability to earn an income is usually one of your biggest assets, so why not protect it? A sudden illness or injury can keep you from working and leave you in financial difficulty. You may get help from a worker’s compensation payout or personal savings, but are they enough to […]

A new scheme may help you make your dream of owning a home come true. High property prices have made owning a home unattainable for many prospective first time buyers. But the First Home Super Saver scheme, passed by the Australian Government in December 2017, may help keep their dream of […]

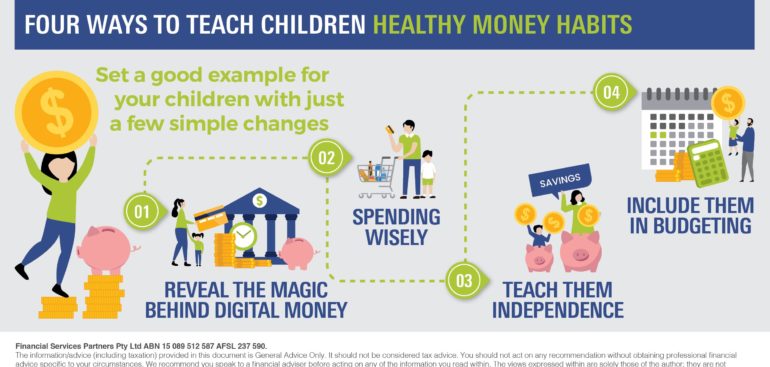

Set a good example for your children with just a few simple changes. As a parent, you try to ensure your children have the skills to make smart financial decisions. For example, you tell them about the importance of saving or the power of compounding interest. But did you know that […]

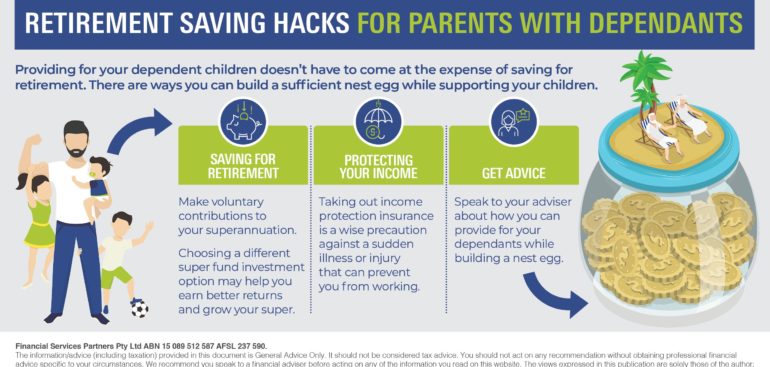

You can build your retirement savings while supporting your dependants. Providing for your dependent children doesn’t have to come at the expense of saving for retirement. There are ways you can build a sufficient nest egg while supporting your children. Saving for retirement Forced saving can be your ally in building […]

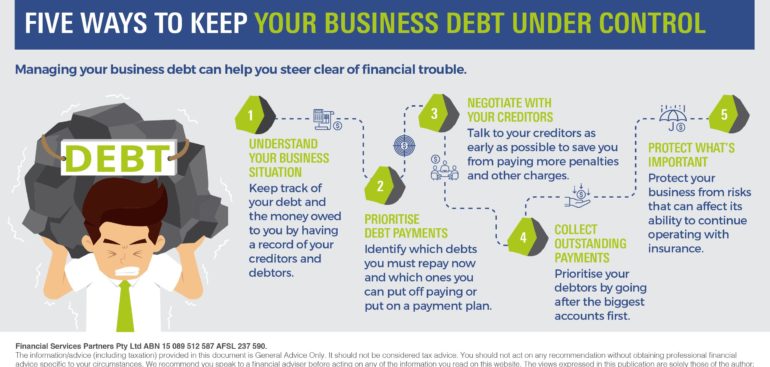

Managing your business debt can help you steer clear of financial trouble. Piling up a lot of debt could leave your business in financial difficulty or, worse, bankrupt. Here are five ways that may help you manage debt and avoid a financial mess. 1. Understand your business situation It’s important to […]

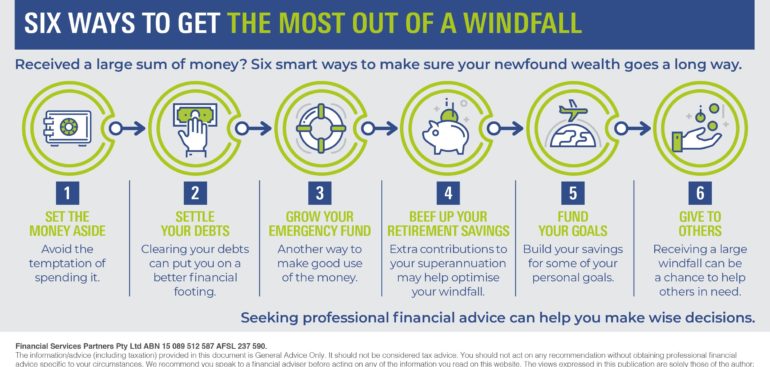

Received a large sum of money? By taking some practical steps, you can make sure your newfound wealth goes a long way. Research has shown that on average, people who receive an inheritance spend about half of it. So how can you make sure your windfall doesn’t just vanish but helps […]

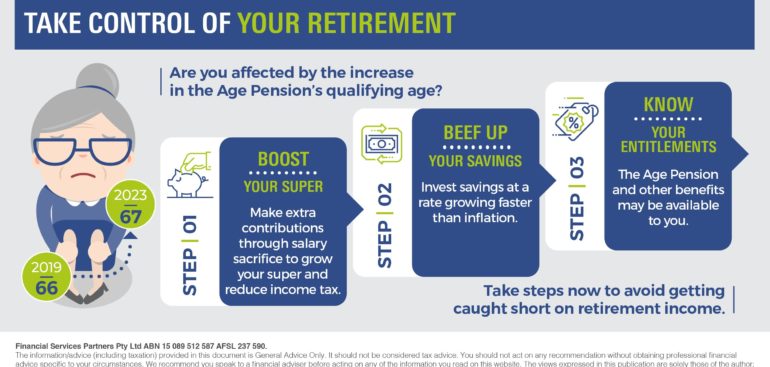

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income. The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age increases by six […]