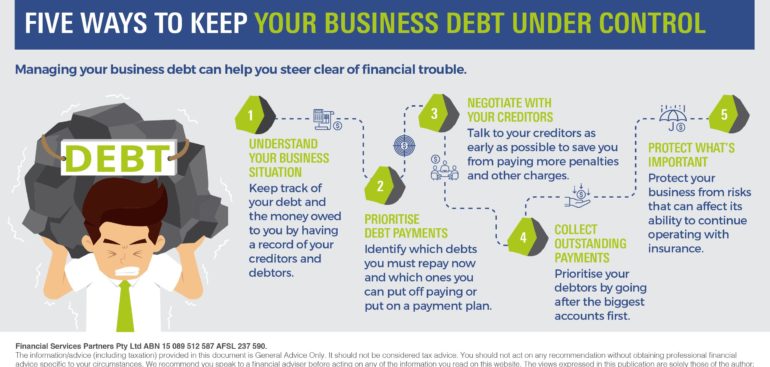

Managing your business debt can help you steer clear of financial trouble.

Piling up a lot of debt could leave your business in financial difficulty or, worse, bankrupt. Here are five ways that may help you manage debt and avoid a financial mess.

1. Understand your business situation

It’s important to keep track of your debt and the money owed to you by having a record of your creditors and debtors and the amounts involved. If tracking your business finances requires more than just a simple spreadsheet, you may want to consider using a bookkeeping system to make monitoring your finances more efficient.

2. Prioritise debt payments

Once you have a good understanding of where your business stands financially, you can prioritise your debts. This requires identifying which debts you must repay now and which ones you can put off paying or put on a payment plan. When prioritising, consider the urgency of the debts or the importance of the creditors to your business.

3. Negotiate with your creditors

It may help to speak to your creditors about

your business situation. You could ask if they have any hardship provisions or

to have your due date extended. Talking to your creditors as early as possible

could save you from paying more penalties and other charges. It may also be a

good chance to negotiate for better terms and rates on your business loans.

4. Collect outstanding payments

You may want to collect payments from debtors to help improve your business cash flow. If you have a long list of debtors, you could prioritise them by going after the biggest accounts first.

5. Protect what’s important

There are steps you can take to help protect your business from risks that can affect its ability to continue operating. Taking out a business insurance policy, for example, may help you by replacing lost income or maintaining cash flow. A financial adviser may be able to help you determine if business insurance might work for you.