As of July 1, the government has taken the following measures in order to make the superannuation system more sustainable and flexible enough to suit modern work patterns. New tax threshold for high-income earners is $250,000, leading to 15% tax increase and annual concessional (before-tax) contributions capreduced to $25,000. Non-concessional contribution […]

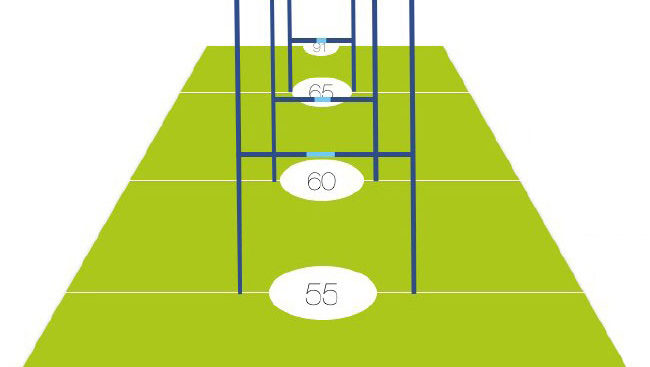

No wonder they keep moving the goal posts. Every year, it seems, they change the rules – the retirement age, the contributions cap, and so it goes on. No wonder one in three Australians are concerned about legislative changes being made to super – what they mean and how to work […]