As of July 1, the government has taken the following measures in order to make the superannuation system more sustainable and flexible enough to suit modern work patterns. New tax threshold for high-income earners is $250,000, leading to 15% tax increase and annual concessional (before-tax) contributions capreduced to $25,000. Non-concessional contribution […]

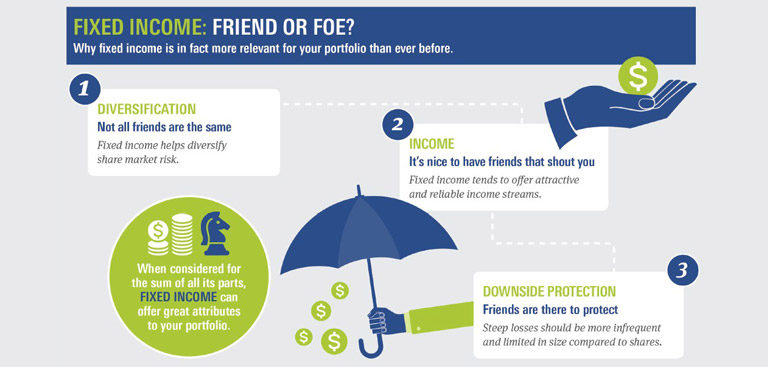

For the past 20 years, fixed income has been a friend to investors. The annualized return for domestic and global fixed income has by far exceeded global share returns. This success has many people questioning if fixed income might become a foe in friend’s disguise in the future. The answer is […]

There is a tendency, once people retire, and have their lump sum invested or an annuity in place, to think that they won’t really need professional financial advice. What we can tell you from experience, is that the exact opposite is true. We find that we actually spend much more time […]

Keeping in Touch – December 2016 Download Keeping in Touch – December 2016 Income protection – what’s all the fuss? Many people automatically insure their car, their home, even their boat, but overlook their most important asset – themselves.

Keeping in Touch – November 2016 Download Keeping in Touch – November 2016 Planning for the year ahead As the end of 2016 approaches, now is an excellent time to start thinking about your finances, and how you can get yourself set for the year ahead.

Keeping in Touch – October 2016 Download Keeping in Touch – October 2016 It’s often said that building financial wealth isn’t a function of how much you earn, but how well you manage it. If you want to consider how to build your wealth, chances are you could use a little […]

Keeping in Touch – September 2016 Download Keeping in Touch – September 2016 Taking control of your (financial) future For many women, starting again after being left widowed or divorced can be difficult and overwhelming. We look at how good financial advice can make a real difference.

Keeping in Touch – August 2016 Download Keeping in Touch – August 2016 Election update: how will your finances be affected? Now that the election has been finalised, here we look at some of the new government’s policy changes that could have an impact on your financial situation.

Keeping in Touch – July 2016 Download Keeping in Touch – July 2016 Are you on track to enjoy your retirement? For many people, the decision around when to retire can be one of the most exciting, yet daunting, times of their lives. There are a number of strategies you can […]

Keeping in Touch – June 2016 Download Keeping in Touch – June 2016 Making the most of lower interest rates While lower interest rates are great for those with mortgages, it does not suit everyone and can make things a lot more difficult for those needing income in retirement. Here we […]