Take the pain out of managing your family’s finances. Taking care of household finances can be taxing, especially if you have a big family. But with proper planning and budgeting, there’s no need to stress. Here are some tips to help you effectively manage your household finances. 1. Examine your finances […]

We all like a good cost saving tip, even if it is something we already know, it never hurts to revisit some top tips and take a look at our current situation to see if there are savings to be made. Any little savings we make throughout the year can be […]

According to research by TAL insurance provider the cost of personal insurance soars after the age of 35. This is also the time in our lives that you may be going through significant change such as marriage, children, a bigger mortgage and more responsibilities. In the previous 5 years to 2017, […]

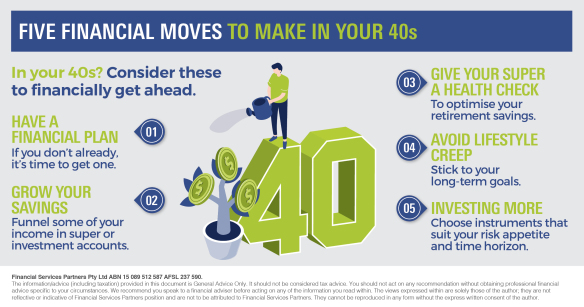

Five financial moves to make in your 40s In your 40s? Here’s what you need to consider to financially get ahead. Being in your 40s often involves balancing many responsibilities that it becomes easy to neglect your own financial wellbeing. But it’s not too late to secure your future. Here are […]

With the beginning of what is to be a continuing myriad of blogs post the blaring underlying question would seem to be “where to begin?”. The beginning point would seem to be an aspect of finance that not only affects the select few, but every individual. An overall encompassing topic that […]

No business expects bad times but unfortunately, they knock our doors without invitations. It could be in form of accident of a key person in business or even loss of life of that crucial identity. But what leaves behind is a financial loss that your company might not be able to […]

As of July 1, the government has taken the following measures in order to make the superannuation system more sustainable and flexible enough to suit modern work patterns. New tax threshold for high-income earners is $250,000, leading to 15% tax increase and annual concessional (before-tax) contributions capreduced to $25,000. Non-concessional contribution […]

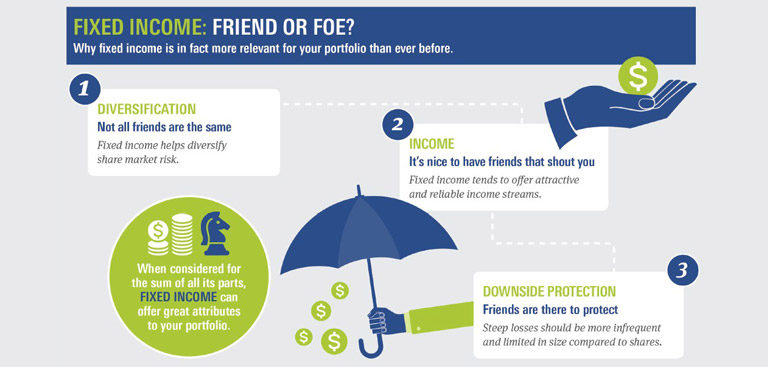

For the past 20 years, fixed income has been a friend to investors. The annualized return for domestic and global fixed income has by far exceeded global share returns. This success has many people questioning if fixed income might become a foe in friend’s disguise in the future. The answer is […]

There is a tendency, once people retire, and have their lump sum invested or an annuity in place, to think that they won’t really need professional financial advice. What we can tell you from experience, is that the exact opposite is true. We find that we actually spend much more time […]

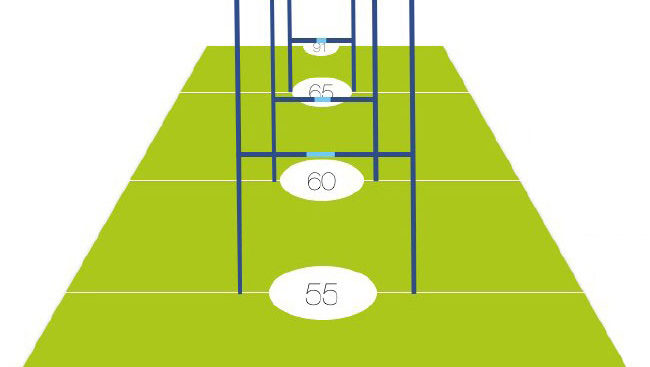

No wonder they keep moving the goal posts. Every year, it seems, they change the rules – the retirement age, the contributions cap, and so it goes on. No wonder one in three Australians are concerned about legislative changes being made to super – what they mean and how to work […]