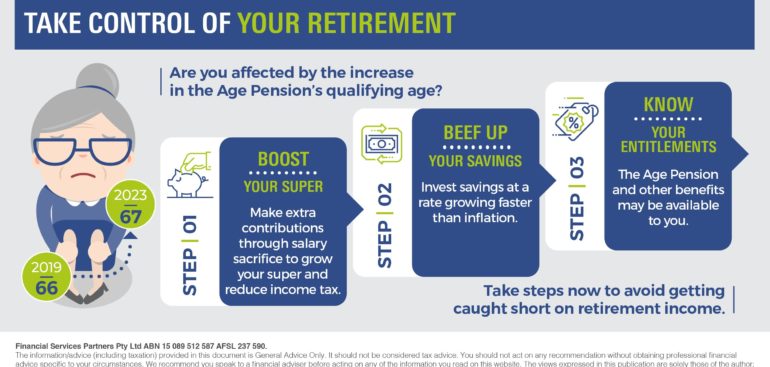

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income.

The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age increases by six months every two years until it reaches 67 in July 2023. It rises to 66 in July this year.

So if you’re turning 45 this year and plan to retire when you reach 60, you will need to wait until you’re 67 before you can apply for the Age Pension. You’ll have to rely on your own savings and super in the interim, making it crucial to ensure you have enough money put away for later years. But the good news is that there’s still time to grow your retirement savings.

Boost your super

Contributing more to your super can be a reliable route to bolstering your retirement fund. By making extra contributions through salary sacrifice, you can grow your super and at the same time reduce the amount of income tax you pay. The government will tax your salary sacrificed contributions at 15 per cent, which could be much lower than your marginal tax rate.

Making non-concessional or after-tax contributions is another option. You can contribute up to $100,000 each financial year if your total superannuation balance is less than $1.6 million. To understand how these contributions work, it’s wise to get professional advice.

Beef up your savings

Your personal savings can supplement your super payments in retirement. But are they growing enough now to provide you with some income when you retire?

To build up your savings, you may have to invest part of it and make sure it’s growing faster than the rate of inflation. Investing in a managed fund or buying an investment bond may help you increase your nest egg, but you should seek professional advice to see if these instruments are appropriate for you.

Know your entitlements

Besides the Age Pension, you may be eligible for other government benefits and concessions. The Seniors Card, for example, offers individuals over the age of 60 discounts on some commercial and public services. Concessions that allow you to buy prescription medicine at a discount are also available.

But keep in mind that these benefits have strict eligibility rules. There’s also no guarantee that these entitlements will still be available by the time you retire. So take charge of your retirement. By working with your financial adviser, you can develop a strategy that helps ensure you’ll be well provided for regardless of changes to pension policies.