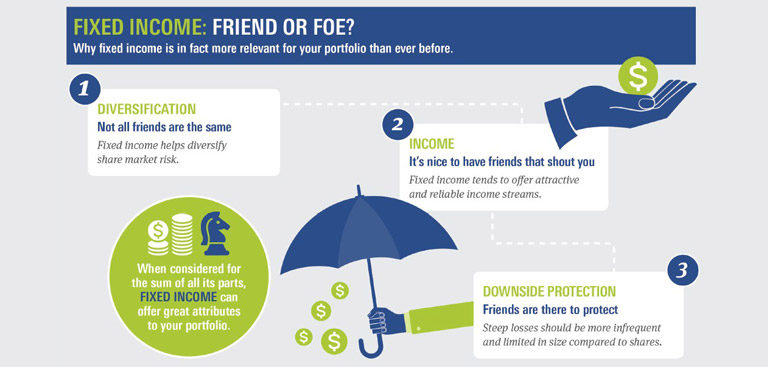

For the past 20 years, fixed income has been a friend to investors. The annualized return for domestic and global fixed income has by far exceeded global share returns. This success has many people questioning if fixed income might become a foe in friend’s disguise in the future. The answer is no, fixed income is now more relevant than ever.

- When it comes to the diversification of the share market risk, traditional fixed income strategies are a vital part. Especially during economic downturns by cushioning portfolio returns. But the correlation that exists between fixed income and shares varies as per the different securities present on the different fixed income securities. Government bonds are considered as general diversifiers with their less credit risks as compared to certain fixed income securities with big credit risks.

- One of the major plus points of fixed income is the fact that it ensures positive, regular source of income returns. Which is because the income payments are made in coupons which are basically interest payments. The coupon income return is at present positive even if the price returns for fixed income are negative.

- Fixed income provides downside protection making the steep losses infrequent and small in size compared to shares. It is vital to know that like all friendships, even fixed incomes have downturns, depending on certain investment periods and interest rate cycle. But certain constrained bond funds have targets that need to be met, thereby ensuring positive returns in all market and interest rate conditions.

- Fixed income might suffer when the interest rate increases, especially the fixed income of traditional sorts. When thinking in short term there might be difficulties but in the long term, a rising interest rate will lead to reinvestments being made in higher interest rates(coupons), therein leading to the positive outcome.